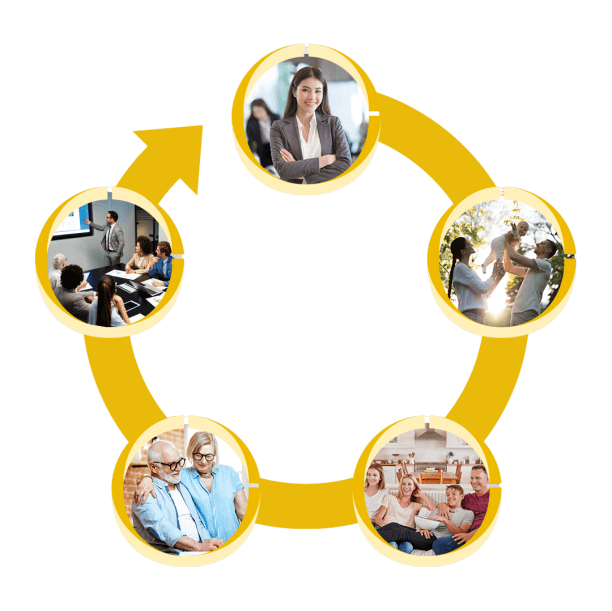

Who We Can Help

Whatever stage you’re at in life, we plan with a vision for a better future without sacrificing your enjoyment now.

Make your money work just as hard as you’ve worked for your money.

Starting Out

You’re never too young to receive financial advice. We believe life is for living, so we’ll help you plan for small changes now for big gains in the future. These are the years to lay the foundation and form good habits that will last the rest of your life.

So while you're planning good times and holidays, you’re still on your way to owning your first home and have a protection plan in place to ensure you and your loved ones are protected.

Generally, the services that are most relevant to this stage of your life are:

- Equities Advice

- Debt and Cash Flow Management

- Superannuation

- Personal Insurance

Starting a Family

You're in the middle of your working life, and while your income is going up, so are your expenses. It can be difficult to juggle everything whilst paying off your mortgage and giving your family the life you want to now and in the future. What if something impacts your ability to work?

Wouldn’t peace of mind be nice?

Generally, the services that are most relevant to this stage of your life are:

- Equities Advice

- Debt and Cash Flow Management

- Investment Property

- Estate Planning

- Superannuation

- Personal Insurance

- Investment Management

- Tax Minimisation

Mature Family

You are in your peak earning years and have the mortgage under control. Your partner works and children are growing up and require less supervision/have left home. You are thinking about retirement.

Generally, the services that are most relevant to this stage of your life are:

- Retirement Planning

- Risk Management

- Superannuation

- Estate Planning

- Structuring Advice

- Investment Management

- Tax Minimisation

Pre-Retirees and Retirees

After all the hard years of work, now’s the time to make sure it pays off. The plans and structures you had for building wealth start to change and you want a strategy that maintains your wealth while allowing you to draw down and allow you to live the retirement that you’ve dreamed of all the way through.

Generally, the services that are most relevant to this stage of your life are:

- Retirement Planning

- Risk Management

- Superannuation

- Estate Planning

- Structuring Advice

- Pension Establishment and Management

- Investment Management

- Tax Minimisation

Estate and Multi-Generational Advice

Wouldn’t it be nice to make sure your children and grandchildren are financially secure after you’re no longer around?

If you’re planning on leaving a financial legacy, you need someone on your side to help build, manage and protect it, and ultimately to future-proof it.

Generally, the services that are most relevant to this stage of your life are:

- Asset Protection

- Estate Planning

- Multi-Generational Advice

- Tax Minimisation

Case Studies

Our Clients Stories

Read stories about clients we have helped navigate financial challenges and create a plan for their future.

Clients Feedback

Our Clients Reviews

Read about how we helped clients achieve their financial goal.

"Ray is an incredibly knowledgeable adviser who takes a personal approach to his financial services. He invests the time to understand our needs and provides the support and advice in very simple terms. He is passionate and always available, willing to roll up his sleeves and get his hands dirty, going above and beyond for every little aspect to ensure we get the best results. With Ray's expertise, we have had great success across our investments, and we appreciate so much having a driven, experienced and yet humble adviser to support and navigate us through our financial journey. Thank you Ray!"

"Raymond assisted me with a number of different areas. He helped me with my superannuation, share transactions, and tax strategies for my first property purchase. He also assisted in reviewing various debt options for the purchase of my first property and how we would structure things to build for the future. I am very happy with their services and would recommend them to others."

"Adam brings a refreshing, modern approach to financial advice while maintaining a high level of trust and reliability. His insights are forward-thinking, tailored, and always backed by a deep understanding of financial strategies. With Adam, you get the perfect balance of innovative solutions and dependable service."

"Adam's ability to communicate the complexities of explaining how to achieve financial sustainability and how to fully use the advantages of superannuation in easily understandable terms is a testament to his professionalism and shared values with M&A Wealth. I would not hesitate to recommend Adam to any person wanting to benefit from his knowledge and experience in all aspects of personal finance."

"After going through a divorce, the last thing I wanted to do was look at my finances for the future. It all seemed very scary and complicated to plan for the future while I was trying to start fresh in my life at the same time. I highly recommend that anyone going through something like this has a chat with Adam. He has helped me by giving me a financial plan moving forward, he showed me that I have options and that it is possible to enjoy my life now and still work towards enjoying my retirement in the future. He's helped me with investing my money, my superannuation, my cashflow and budget and my tax situation."

"Adam has helped me with a number of different areas in my personal financial situation. He has helped me with my investment management around my share transactions, my superannuation, managing my cashflow and overall budget and tax strategies. This has all allowed me to go enjoy my life having peace of mind knowing that my finances are looked after by Adam. I am more than happy with the services he provides and would highly recommend him."

Start Your Journey Now

It is critical to take advantage of your position and begin to maximise your opportunities now. Have a chat with us to see how we can help you Build, Manage and Protect your wealth.

"We are so grateful that we were introduced to Raymond many years ago as he has helped us with so many things and in so many different ways that it has made our life so special that we are so happy to be clients of his. Our family and life has improved so much since becoming friends and clients of his He is so clever with our investments that we shake our heads sometimes and wonder what is going to happen next. He not only helps us but is so approachable that he is happy to help us with any questions we have about things with our children as well. I would recommend him to anyone else who needs help with their investments and superannuation. Available anytime for us to speak to and is very helpful and happy to help us with any questions or issues we have. Fantastic service and support all the time."